How Many Tariffs Does It Take to Resurrect a Dead Factory in Ohio?

Nixon, Bretton Woods, Fiat Currencies, and the New World Order

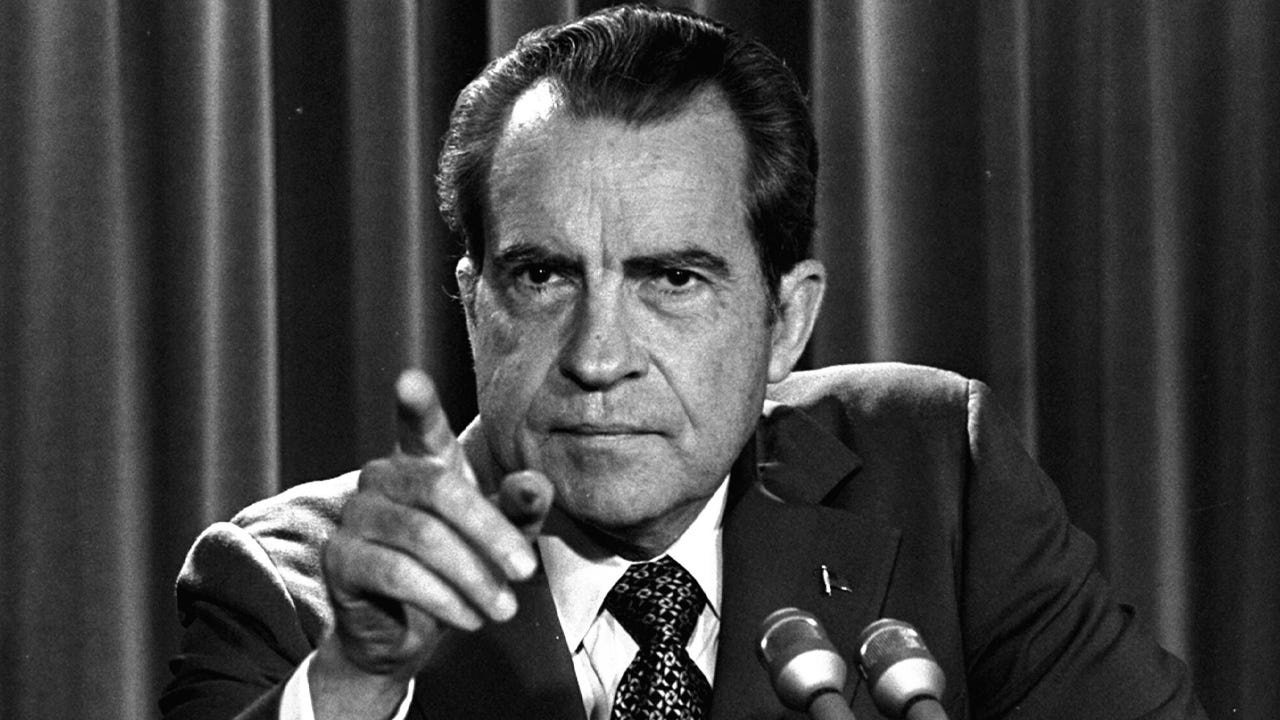

The moment when our imperial delusion began has a specific date: August 15, 1971. On that day, Nixon was addressing the nation, on television screens across America, announcing what amounted to a national default, with the slick evasiveness that made his name synonymous with political corruption. He announced he had just killed the gold standard. Poof, Bretton Woods was gone, and so was America’s promise to back its money.

But markets didn’t crash on the news of this default; they rallied.

This wasn’t just a policy oopsie; this was the moment we decided reality was optional, and everyone just played along. We can print money from nothing whenever we need, and we can buy goods and balloon our national debt, and it’s just a number with no consequences. We’ve been snorting this fiat fairy dust since 1971.

Contemporary American politics across the spectrum seems to share a common delusion: American hegemony is eternal, divinely ordained, the end point of history itself. But the history of empires is that they rise, they bloat, they fester, and inevitably crash under the weight of their own contradictions.

Our current political moment seems so confusing, with escalating trade wars and global upheaval. It seems unnecessary. Why do tariffs and trade deficits and bond yields and debt ceilings and currency valuations suddenly matter so much? But these are the tremors of a changing world order, and to fully understand our chaotic present, we must revisit 1971. And 235 AD. And a few dates in between.

Post-World War II, America was the global prom queen, and the dollar was her crown. The dollar’s power came from the gold standard, a promise that every